Closing Entries Are Necessary For

What are Closing Entries in Accounting?

Closing Entries in Bookkeeping are the different entries fabricated at the terminate of any bookkeeping year to nullify the balances of all the temporary accounts created during the accounting flow and transfer their balance into the respective permanent account.

In elementary words, Closing entries are a set of journal entries fabricated at the cease of the bookkeeping period to move balances from temporary ledger accounts Ledger in accounting records and processes a house's fiscal data, taken from journal entries. This becomes an important financial tape for future reference. It is used for creating financial statements. It is also known as the 2nd book of entry. read more than like revenue, expense, and withdrawal/dividends to permanent ledger accounts.

- It is like resetting the balances of temporary accounts to zero to go far clean to be used in the next accounting period, meanwhile hitting the residual sheet accounts with their balances. Information technology is also known as endmost the books, and the frequency of closing can vary equally per the size of a visitor.

- A large or mid-size firm unremarkably opts for monthly endmost to fix monthly fiscal statements Fiscal statements are written reports prepared by a company'due south management to nowadays the company's financial affairs over a given catamenia (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Argument, Greenbacks Flows, and Shareholders Disinterestedness Statement, must be prepared in accordance with prescribed and standardized bookkeeping standards to ensure uniformity in reporting at all levels. read more and gauge the performance and operational efficiency. However, a small business firm can go quarterly, semi-annually, or even almanac closing.

Table of contents

- What are Endmost Entries in Bookkeeping?

- Steps for Posting Closing Entries Journal

- Case of Closing Journal Entries

- Types

- #one – Temporary accounts

- #2 – Permanent accounts

- Recommended Articles

Y'all are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to exist Hyperlinked

For eg:

Source: Closing Entries in Accounting (wallstreetmojo.com)

Steps for Posting Closing Entries Journal

- Endmost Revenue & Expense: It involves transferring the balances of the whole accounting period from the revenue account and expense business relationship to the income summary account.

- Endmost Income Summary: Moving the internet income or internet loss Net loss or net operating loss refers to the excess of the expenses incurred over the income generated in a given accounting period. It is evaluated every bit the deviation between revenues and expenses and recorded as a liability in the residual sheet. read more from the income summary account to the retained earnings business relationship of the balance sheet.

- Closing Dividends: If there has been a dividend pay-out The dividend payout ratio is the ratio between the total amount of dividends paid (preferred and normal dividend) to the visitor's internet income. Formula = Dividends/Cyberspace Income read more then transferring the remainder from Dividends account to the retained earnings Retained Earnings are divers every bit the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the function of owner'due south equity in the liability side of the residual sail of the company. read more account

Example of Closing Journal Entries

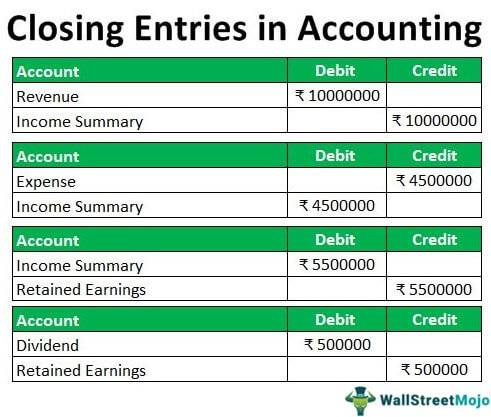

To look at it more practically, let's take closing entries journal example of a small manufacturing company ABC Ltd which is going for the annual closing of books:

ABC Ltd. earned ₹ 1,00,00,000 from sales revenue over the twelvemonth 2018 so the revenue account Revenue accounts are those that report the business's income and thus accept credit balances. Revenue from sales, revenue from rental income, acquirement from interest income, are information technology'due south mutual examples. read more has been credited throughout the yr. At the finish of the year, it needs to be zeroed out by debiting it and crediting the Income summary business relationship.

| Account | Debit | Credit |

|---|---|---|

| Revenue | ₹ 1,00,00,000 | |

| Income Summary | ₹ 1,00,00,000 |

Let'due south too presume that ABC Ltd incurred expenses of ₹ 45,00,000 in the raw material purchase, mechanism purchase, bacon paid to its employees, etc., over the bookkeeping year 2018.

All these examples of endmost entries in journals have been debited in the expense business relationship. At the end of the accounting year 2018, the expense account needs to exist credited to clear its balances, and the Income summary business relationship should be debited.

| Account | Debit | Credit |

|---|---|---|

| Expense | ₹ 45,00,000 | |

| Income Summary | ₹ 45,00,000 |

So for posting the endmost entries in the general ledger, the balances from acquirement and expense business relationship volition be moved to the income summary business relationship. Income summary account is as well a temporary account that is but used at the finish of the accounting period to pass the closing entries journal. It is not reported anywhere.

The net remainder of the income summary account would be the net turn a profit or internet loss incurred during the catamenia.

In the to a higher place case, a internet credit of ₹ 55,00,000 or profit will finally be moved to the retained earnings account by debiting the Income summary account. The accounting assumption Accounting assumptions are a prepare of rules that ensures an organisation'southward business operations are conducted efficiently and as per the standards divers past the FASB (Financial Bookkeeping Standards Board), which ultimately helps lay the groundwork for consistent, reliable and valuable information. read more here is that any turn a profit earned during the menstruum needs to exist retained for employ in hereafter company investments.

| Account | Debit | Credit |

|---|---|---|

| Income Summary | ₹ 55,00,000 | |

| Retained Earnings | ₹ 55,00,000 |

Something noteworthy hither is that the above closing entry can be passed even without using the income summary account An income summary is a transitory business relationship created to transfer all the expenses and acquirement accounts at the end of the accounting flow. An increase in credit side residuum exhibits profit, while a college debit side balance shows a loss. read more than . i.e., moving the balances straight from revenue and expense account Expense accounting is the bookkeeping of business costs incurred to generate acquirement. Accounting is done against the vouchers created at the time the expenses are incurred. read more to the retained earnings account. Just using the income summary business relationship was used to give a articulate view of the company's functioning when there was only manual accounting. Usually, where the accounting is automatic or washed using software, this intermediate income summary An income summary is a transitory account created to transfer all the expenses and revenue accounts at the end of the accounting menstruum. An increase in credit side balance exhibits profit, while a higher debit side rest shows a loss. read more account is non used, and the balances are directly transferred to the retained earnings account. The temporary accounts need to exist goose egg at the end of an bookkeeping period.

Coming back to our initial case, let'south suppose that ABC Ltd as well paid out dividends worth ₹ v,00,000 to its shareholders during the accounting year 2018, i.east., the dividend business relationship has a debit balance In a General Ledger, when the full credit entries are less than the total number of debit entries, information technology refers to a debit balance. A debit balance is a cyberspace corporeality often calculated as debit minus credit in the General Ledger later recording every transaction. read more than of ₹ 5,00,000, which needs to be credited and then directly debiting the retained earnings business relationship. Since the dividends business relationship is not an income statement account, information technology is straight moved to the retained earnings account.

| Business relationship | Debit | Credit |

|---|---|---|

| Dividend | ₹ five,00,000 | |

| Retained Earnings | ₹ v,00,000 |

Eventually, afterwards following the above steps, the temporary account residuum will be emptied into the balance sheet accounts.

Types

Below are the types of Closing Entries segregated into Temporary and Permanent accounts:

You lot are free to use this paradigm on your website, templates, etc, Please provide us with an attribution link Article Link to exist Hyperlinked

For eg:

Source: Closing Entries in Bookkeeping (wallstreetmojo.com)

#1 – Temporary accounts

Temporary Accounts entries are only used to tape and accumulate the accounting or financial transactions over the bookkeeping twelvemonth, and they do non reverberate the company's fiscal performance. So it is essential to clear the balances of temporary account Temporary accounts are nominal accounts that kickoff with nada residuum at the commencement of the fiscal year. The balance is visible in the income statement at the twelvemonth-end and so transferred to the permanent as reserves and surplus. read more and so that, for instance, revenues and expenses for ABC Ltd. for the bookkeeping twelvemonth 2018 should exist isolated and non be mixed with revenues and expenses of the year 2019.

#2 – Permanent accounts

Permanent Business relationship entries show the long-standing financial position of a company. Information technology is necessary to transfer the balances to this account considering information technology takes into account the advisable consideration of assets or liabilities for future utilization, eastward.g., Permit'southward suppose ABC Ltd. incurred an expense to buy mechanism to be used for manufacturing, it is going to exist utilized in the future years and non just in the accounting twelvemonth in which information technology was recorded, so information technology needs to be moved to the balance sheet account A balance sheet is one of the financial statements of a visitor that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the possessor'south upper-case letter equals the full assets of the company. read more from the temporary account.

So, if the closing entries journal is not posted, there will be incorrect reporting of financial statements. And not having an accurate delineation of modify in retained earnings might mislead the investors about a visitor'due south financial position.

Hence, potent accounting regulations and policies restrict the public listed companies from abusing certain loopholes while producing their financial reports. Apart from the guidelines, there are strict auditing rules to protect and ensure the integrity of the numbers existence reported for whatsoever bookkeeping menstruation Accounting Period refers to the catamenia in which all financial transactions are recorded and financial statements are prepared. This might exist quarterly, semi-annually, or annually, depending on the catamenia for which you want to create the financial statements to be presented to investors and then that they can track and compare the company'southward overall performance. read more than . Having an intermediate income summary account proves helpful to the accountant here equally it provides a trail of bookkeeping closing entries for each financial transaction.

Recommended Manufactures

This article has been a guide to what Endmost Entries in Accounting are. Here we discussed types of Closing Entries Journal along with practical examples. You lot tin can learn more near accounting with the following manufactures –

- Adjusting Entries Examples

- Examples of Periodical Entries

- What is Journal in Accounting?

Closing Entries Are Necessary For,

Source: https://www.wallstreetmojo.com/closing-entries-in-accounting/

Posted by: powellsence1948.blogspot.com

0 Response to "Closing Entries Are Necessary For"

Post a Comment